Tackling the email overload in financial services: Challenges and solutions

Share at:

Emails have been an integral part of business communication for decades. While many companies are turning to digital assistants, chatbots, and voice-based solutions to help customers quickly, email is still a primary way to communicate.

According to Gartner, the resolution rate of chatbots has a very broad spectrum. Depending on the issue type, resolution rates range from as low as 17% to as high as 58%. The rest have to be routed over to a live agent, or the discussion continued in emails.

Email remains a preferred communication channel for customers due to simplicity, accessibility, ease of usability over web and mobile, and providing a written record. However, as the volume of emails grows exponentially, managing and responding to them has become an increasingly significant challenge—especially for large organizations.

The scale of the problem

The sheer volume of emails received by businesses is staggering. Large banks, for instance, can receive anywhere from 10 to 50 million emails annually. Even smaller banks and regional institutions face a considerable influx, receiving between five and 10 million emails per year.

Emails range from simple inquiries about account balances to complex issues requiring specialized knowledge. Even with dedicated customer service teams, it's challenging to respond to every email in real time.

A recent article identified email as the primary avenue of customer communication after social media for banks.

One large private bank leverages SMS and emails as their preferred mode of engagement with their customers, sending approximately 3.5 million emails and texts per month. Roughly 60% of their customers signed up to receive alerts via emails and texts.

The limitations of traditional email management

Traditional, rule-based email triaging systems struggle to keep up with the scale and complexity of modern email volumes. These systems often rely on predefined rules and keywords to categorize and route emails, which isn’t effective in handling complex or ambiguous queries. As a result, many emails end up being misclassified or routed to the wrong employees, leading to delays in response times.

Furthermore, existing tools are primarily designed for effective triaging, not automation. This means that many customer queries still require manual intervention, resulting in long wait times for customers.

Email-intensive functions and processes

Customer service: the most obvious recipient of emails, customer service handles a wide range of inquiries, from account balances to disputes and complaints.

Wealth management: clients often seek advice and updates on their investments and portfolios via email.

Loans and mortgages: customers submit questions about their loan terms, repayments, and interest rates via email.

Digital banking: technical support and troubleshooting for online and mobile banking services are frequently addressed through email.

The impact on customer experience

Slow response times and inaccurate email handling can have a detrimental impact on customer satisfaction. In a report released by Talkdesk on the global state of the customer experience (CX), 65% of customers are willing to switch brands if unsatisfied. While customers expect a reply within minutes (or within the hour), the reality leaves a lot to be desired. A benchmark study revealed that the response time for emails from companies to their customers varies greatly, ranging from 12 hours to a few days.

In addition to delayed responses, misclassified or mishandled emails can also lead to customer dissatisfaction. For example, if a customer's complaint is mistakenly routed to a sales team instead of customer support, they may receive irrelevant responses.

The role of AI + automation in email management

To address the challenges posed by the growing volume of emails, businesses must adopt AI + automation solutions.

These solutions can help to:

Automate routine tasks: by automating tasks like email categorization, routing, and even basic responses, businesses can free up human agents to focus on more complex queries.

Improve response times: automation can significantly reduce response times, ensuring that customers receive timely and relevant information.

Enhance customer satisfaction: faster response times and more accurate information can lead to improved customer satisfaction and loyalty.

AI techniques, such as natural language processing (NLP) and machine learning, can further enhance email management capabilities. NLP can be used to understand the content of emails, identify customer intent, and route emails to the appropriate agents. Machine learning algorithms can learn from historical data to improve email classification accuracy over time.

The future of email management

As email communication continues to evolve, businesses must stay ahead of the curve by investing in AI + automation solutions.

By embracing AI + automation, organizations not only manage the growing volume of emails but also provide exceptional customer service and drive business growth.

Ensuring SLA adherence by leveraging email metadata for automation

Banks need to track key service-level agreement (SLA) metrics such as average response time, aging of the emails in respective queues, and triaging accuracy of the incoming emails. Much of these details for SLA metrics can be extracted and tracked from the metadata of the incoming emails as exemplified below.

Besides the obvious information in the body of the email, there is a lot of intelligence that can be unlocked via the metadata of the email. Banks can extract valuable metadata from emails and use the extracted data to draw insights and build automations.

Email metadata includes:

Sender information: the sender's name, email address, and associated account details can be used to identify the customer and route the email to the appropriate department.

Subject line: the subject line often provides clues about the query or request, allowing for automatic categorization and routing.

Date and time: the timestamp can be used to prioritize urgent emails and track response times.

Email attachments: attached documents can be analyzed to extract relevant information or trigger specific actions.

Thread count: The thread count of email conversation is a good lever to identify the transactional emails. Requests received for such emails can be readily automated via self-serve channels.

The extracted metadata can be utilized in many ways to optimize the customer experience. For example, UiPath Communications Mining™ helps in the email load analysis to determine peak email volumes from a particular domain or sender.

The pattern analysis (powered by UiPath Communications Mining) can help determine the common types of recurring emails by volume. Now, armed with this intelligence, organizations can look to automate the most common, most transactional emails.

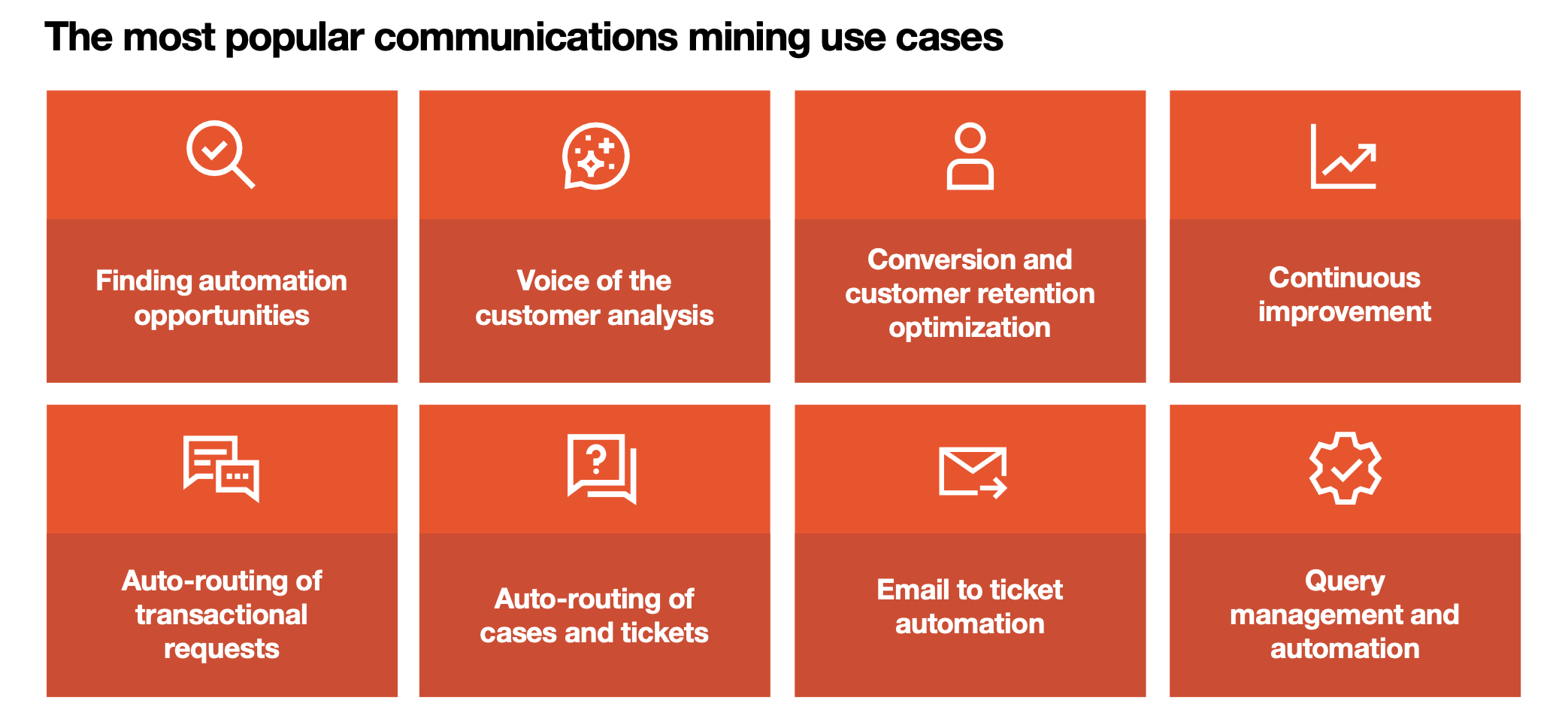

Here is a detailed look into UiPath Communications Mining.

UiPath Communications Mining for enhanced email and communications management

UiPath Communications Mining is a powerful, low-code capability that uses state-of-the-art AI to turn almost any message into structured and actionable data.

Communications Mining focuses on understanding and extracting value from communications-based processes. It uses a combination of specialized AI and generative AI models to convert business communications like emails into structured data for analysis, opportunity discovery, and the downstream automation of communications-based processes.

In-house solutions and manual methods of message processing are mostly generic in nature, lack context, and are often inaccurate.

UiPath Communications Mining can be scaled rapidly across the business.

UiPath Communications Mining models are fast and easy to train. And the intuitive, low-code interface means any employee can analyze and automate their communications work regardless of technical ability. Weeks or even months of model training can be compressed into mere hours with the generative extraction capabilities of Communications Mining.

UiPath Communications Mining uses specialized AI, in the form of a specially trained large language model, to automatically discover message clusters that reveal repetitive processes, requests, and issues. Available via the UiPath Platform™, Communications Mining continuously retrains to discover new and valuable insights. The model training time can be further cut down without compromising extraction accuracy thanks to generative extraction capabilities.

UiPath Communications Mining uses generative AI to automatically extract structured data from complex messages (including emails). It can extract multiple intents and contact reasons. This enables the analysis and automation of complex requests.

Source: The Ultimate Guide to Communications Mining

UiPath Communications Mining can significantly enhance and streamline email and communications-based processes within banks.

Triage incoming emails: automatically classify emails based on subject line, keywords, and sender information

Identify high-priority emails: prioritize emails based on urgency, customer sentiment, and other relevant factors

Understand context and customer sentiment: analyze email content to extract key information and gauge customer sentiment. Built-in analytics allow managers to track trends, measure service quality, and performance at all levels.

Prioritize email queries for automation: identify routine or low-complexity queries that can be automated

Automate actions: leverage the power of the wider UiPath Platform to trigger automated responses, route emails to appropriate departments, or create tasks based on email content. Tasks like triaging emails, updating customer information, and case creation can now be automated from end to end.

By leveraging UiPath Communications Mining, banks can streamline their communications and service processes, improve response times, and enhance customer satisfaction.

To explore Communications Mining at depth, get a complete guide on UiPath Communications Mining.

Sales Specialist, Emerging Products (Process Mining and Test Automation), UiPath

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.