Say hello to your new (AI agent) financial services colleague

Imagine a financial services world where loan approvals happen in seconds, claims are processed with pinpoint accuracy, and regulatory compliance is effortlessly managed. This isn’t a distant dream but the promise of agentic automation. Agentic automation is the orchestration of AI, automation, and human in the loop to complete a workflow, driving efficiency, autonomy, and innovation. But what exactly is an agent, and how can financial services organizations prepare for this transformative shift?

What is an agent?

Agents, or AI agents, are like intelligent AI coworkers capable of acting independently and making dynamic decisions. These digital coworkers operate with “controlled agency” and are governed by high-quality context grounding, rigorous testing, and online and offline evaluations. They are "intelligent" because they can process complex data and make decisions beyond the scope of conventional automation.

Agents don’t replace robotic process automation (RPA) robots but rather complement them. Agents act as the advanced decision maker, handling only the steps of a process requiring dynamic decisioning and high adaptability, while robots continue to handle deterministic, rule-based tasks. It’s this synergistic hybrid approach that allows organizations to reap the incredible benefits of generative AI while maintaining strict oversight.

The most critical aspect of deploying agents is ensuring they operate within a governed platform tailored to the enterprise’s unique context. This means adhering to the organization's specific rules and procedures and meeting strict regulatory requirements—an essential mandate in highly regulated industries like financial services.

Agents vs. robots: complementary forces in automation

In financial services, both agents and robots will play distinct but equally crucial roles. Robots excel at executing structured tasks with precision, such as processing transactions or reconciling accounts. Agents, however, bring a higher level of intelligence and adaptability, capable of planning tasks, collaborating with humans and systems, and making real-time decisions.

Take insurance claims processing as an example: a robot might handle routine data entry, while an agent can assess unstructured data from emails, validate claim details, and coordinate systems for faster resolution. Similarly, in insurance underwriting, agents can analyze vast datasets, identify anomalies, and make informed recommendations, enhancing efficiency and accuracy.

Addressing organizational challenges with agentic automation

Financial services organizations run on a complex web of fragmented systems and unstructured data, creating inefficiency across their workflows. Agentic automation offers scalable solutions, including:

End-to-end workflow orchestration: UiPath Agents plan, execute, and monitor processes across complex workflows, agnostic of the applications involved

Understanding and analyzing unstructured data: Agents can analyze data and use that insight in the planning and execution of processes

Reduced reliance on human intervention: Autonomous decision making reduces reliance on human intervention, shifting teams' focus to supervisory roles such as handling exceptions and making approvals

What might this look like in practice?

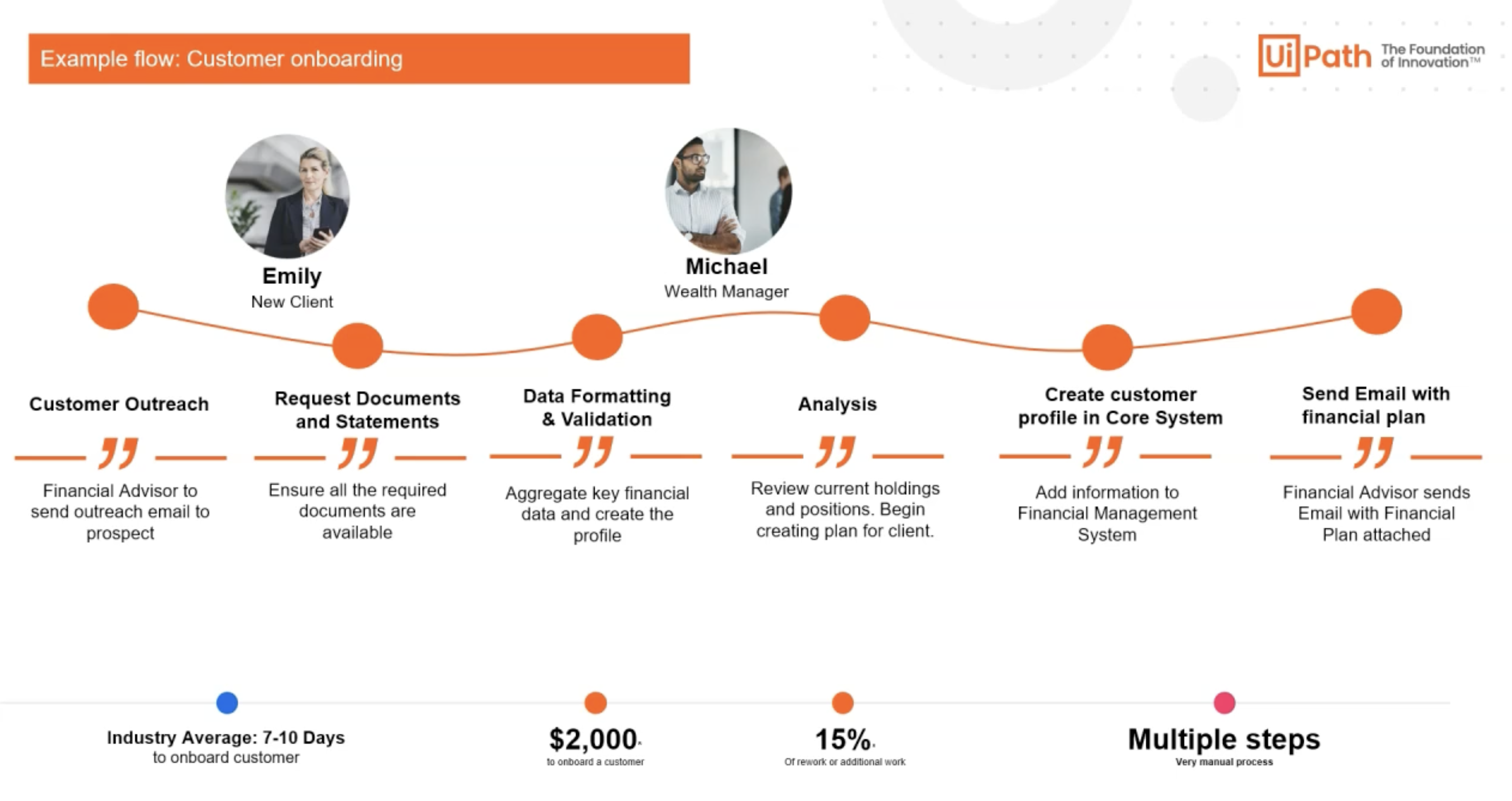

Agentic automation transforms processes like wealth management, client onboarding, and insurance broker onboarding by seamlessly integrating decision making and adaptability into workflows.

In wealth management, AI agents can gather and analyze client data to personalize onboarding experiences, ensuring that portfolios, compliance documentation, and investment recommendations align with individual goals:

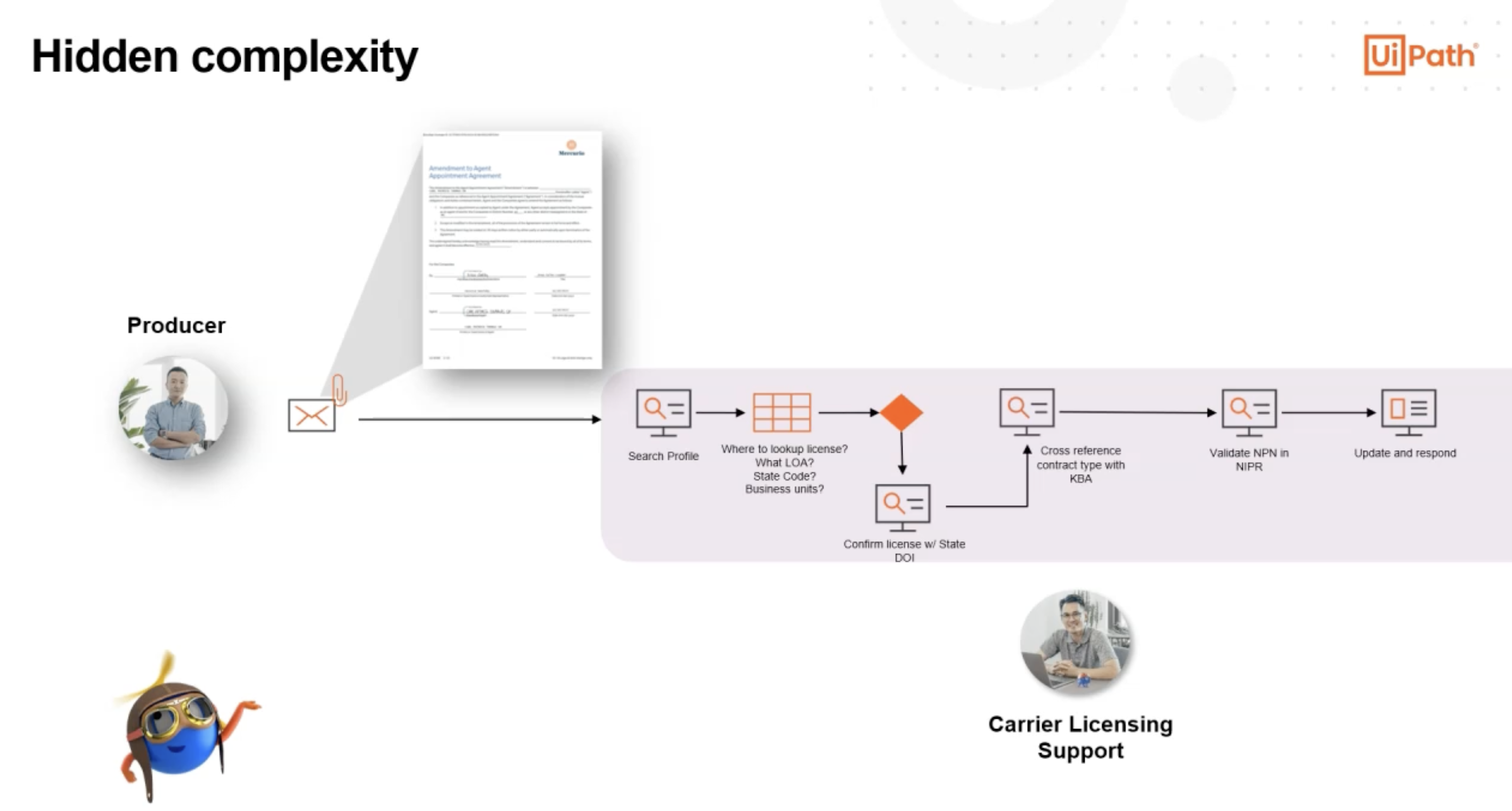

For an insurance broker, agents can dynamically process and validate licensing requirements, guide the broker through compliance steps, and customize onboarding materials based on their role or region. By blending intelligent decision making with automation, agentic automation reduces time to productivity, enhances compliance, and delivers tailored experiences at scale.

The power of agentic orchestration

At the heart of the agentic automation is orchestration—the ability to coordinate tasks seamlessly across agents, robots, and people. Platforms like UiPath assign tasks to the most suitable entity, whether it’s a rule-following robot or an adaptive agent.

Why is this transformative? Financial services firms don’t need another point solution—they need a platform that integrates various systems and capabilities at scale. McKinsey captures it well: “It’s about how the pieces fit together, not the pieces themselves. The challenge lies in orchestrating the range of interactions and integrations at scale.”

This orchestration is critical in financial services, where legacy technology stacks create complexity. Firms need a neutral, well-governed platform like UiPath, often described as the “Switzerland of business applications,” to make sense of fragmented systems and deliver streamlined solutions.

Why are financial services firms excited for this new chapter?

Financial services firms are increasingly excited about agentic automation’s potential to revolutionize operations and customer engagement. Emily Krohne, Enterprise Automation Principal at WEX, highlights one transformative use case: enhancing customer profiles for personalized experiences.

“Being able to read strategic reports, company filings, and pair that with internal reporting allows employees to have better conversations with customers, better understand the competition they’re up against, and gain deeper insights into their industries,” she explains.

This enriched understanding enables teams to tailor sales pitches to individuals rather than relying on surface-level data. “It’s about targeting who the person is rather than just one or two pieces of information,” Krohne emphasizes. Beyond personalization, agentic automation builds trust by working alongside employees. “Having an agent that’s interacting with a human and engaging with them in their process takes some of the pressure away,” Krohne adds, demonstrating how agents can enhance both efficiency and relationships.

The future is agentic

Agentic automation isn’t just about efficiency—it’s about redefining what’s possible in financial services. Imagine agents autonomously managing loan approvals, cross-referencing customer data, and ensuring compliance without bottlenecks.

The path forward is clear: the future of financial services will be shaped by intelligent agents working harmoniously with robots and humans. For organizations ready to embrace this shift, the opportunities are limitless.

Excited to get started building your own agent?

Industry Marketing Manager, FINS, UiPath

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.