How Audit Companies Can Speed up Services with Process Mining

Overshadowed with the global 2019 novel coronavirus (COVID-19) crisis, the year 2020 is bringing a decade of innovations one couldn’t imagine. Businesses are going digital, forced to operate and grow under limited resources.

The year has kickstarted a new era of growth and adaptability. Not only to prosper but survive, businesses now focus on speeding up their processes. In fact, the pandemic is influencing the way people work, touching every organization and industry.

Along with the global market, audit organizations must adapt to new challenges. Auditors today play a major role in assessing risks and guiding businesses on their way to crisis response. Financial reporting must be transparent, and people’s health put as priority.

Under the pandemic crisis pressure, audit organizations must address their projects efficiently. As companies work with limited resources and paused production lines, audit firms can’t afford the luxury of interrupting business operations for a couple of weeks.

Process mining is a great help to an auditor today. It complements the analytical part of the audit project and enables consultants to deepen business processes analysis.

Using solutions like UiPath Process Mining, an auditor spends less time gathering information and can focus on the existing data analysis. This way, an auditor provides equitable recommendations, eliminates long discussions, gains extra trust for the audit results, and improves the relationship between an audit firm and its client.

What do we know about audits today?

A financial audit is the most reliable way of independently evaluating a public company. It's a complex examination of the accuracy of a company's business operations. During the audit, it is important to assure organizational compliance with the state regulations and stakeholder agreements (investors, partners, employees, etc.).

The audit procedure has undergone many changes over the years to reach the point where it stands currently. Professional services firms such as Deloitte, KPMG, PwC, and EY (also called the "Big Four"), lead the audit practices standardization. Their consultants conduct regular, systematic business checkups in areas of finance, management, operations, human resources (HR), IT, and others.

Despite the common perception of an audit as an externally-initiated activity, it’s common for companies to establish an internal audit team.

As scary as it sounds – an audit is inevitable. At some point, every company will face an audit check to assure its long-term livelihood. And it’s a great practice! Regular audits, internal or external, not only ensure compliance but also help you identify emerging risks.

As organizations worldwide are facing pivotal challenges, audits play a big role in guiding businesses out of the crisis. In times of extra hurdles (expansion, investments, crisis, etc.), audits are crucial for businesses to stay on top of risks and be ready to respond to future challenges.

Watch the webinar to find out how LexisNexis transforms risk management with robotic process automation (RPA) in the post-COVID reality.

But how can auditing firms prepare for their own challenges? How can the audit industry adapt to the new norms and support business improvements and transformation? There are three key components to audit organizations being able to adapt to the current business environments:

Internal audit forces

External audit experts

Technology

External auditors switch gears

To test company standards compliance, either finance or law-related, an external auditor starts research on a certain process. They check the underlying documents and conduct interviews with employees to find out process details. Based on gathered information an auditor determines current process issues and potential risks. Then they share suggestions for improvements. Noncompliant organizations might get fines or even end up with litigation.

It is normal for an auditor to spend days and weeks to get the big picture of a process. The main source of knowledge about a process is people, and people tend to perform the process differently from what it is on paper. It is then harder for an auditor to make a precise process analysis that would bring value to the business. Auditors often work with limited information, where the result depends on their professional expertise.

As the COVID-19 virus affects economies around the world, many businesses are pivoting to increase focus on the health of their employees and customers. Which means external auditors need to pay more attention to compliance with governmental and health organizations' guidance.

Business priorities and COVID-19 preventive measures are forcing the audit process to change. Due to the travel restrictions, social distancing, office closures, and limited resources, auditors can't perform projects at a customer’s office.

Audit organizations need to adapt their practices to the digital world, allowing specialists to conduct audit research from any place in the world.

Internal audits are key to a strong COVID-19 response

An internal audit team enables you to set control over financial processes and prevent risks. Internal audits not only help to prepare for an external audit but also measure the “health” of company operations on a regular basis.

The internal audit team:

Monitors factors affecting business performance

Identifies discrepancies, errors, and misuse in processes

Predicts potential risks

And the audit team addresses the issues above at the earliest stage possible.

Compared to external audits, an internal audit enables your company to react fast. It also influences strategic decisions and advice on solving the economic crisis challenges. During this time, your internal auditing team plays a major role in supporting business continuity planning.

An internal auditor can address the crisis-sourced issues and assure that the teams follow procedures set for an emergency.

Related read: Automated Systems Allow Us to Start Building Our Post-COVID-19 World Today

They can also prepare the organization for external audits by minimizing unexpected costs.

An audit is a serious project and one that takes a good part of employees’ time. I It costs money and effort from both internal and external parties. Not only do audits disrupt an organization’s work processes, but it also adds to the employees' stress as they feel the importance of the audit.

Process mining solves a big part of those challenges.

Process mining to the rescue

Among the reviewed material, an auditor can rely on corporate data stored in IT systems. As companies opt for technological transformation and digitalization, the large data sets stored on-premises are too much for an auditing group to analyze using a manual approach.

Consider the global big data trend and imagine how much information is wasted. But what if auditors could avoid exhausting manual investigations and use big data to improve the audit outcome?

Process mining simplifies an auditor’s life and increases audit quality. Now, an auditor doesn’t have to ask the finance team about how their work is going – the system the team uses (like Oracle or SAP) will provide all that information. The team doesn’t have to pause their work and take time for audit interviews. Instead, the auditor relies on data and not paper archives.

When an organization is considering a technological investment, a proof of value (PoV) can help evaluating risks and benefits of that investment. Process mining can support such analysis and provide insights on return on investment (ROI) estimates.

We’ve discussed the reasons to use process mining in a recent blog post, but the main advantage for auditing organizations is in how process mining technology enables auditors to analyze the real process instead of an assumed one. A holistic view of a process is especially crucial for audit companies because process analytics and compliance are at the core of the services they provide. Especially in times of crisis and mandatory risk management.

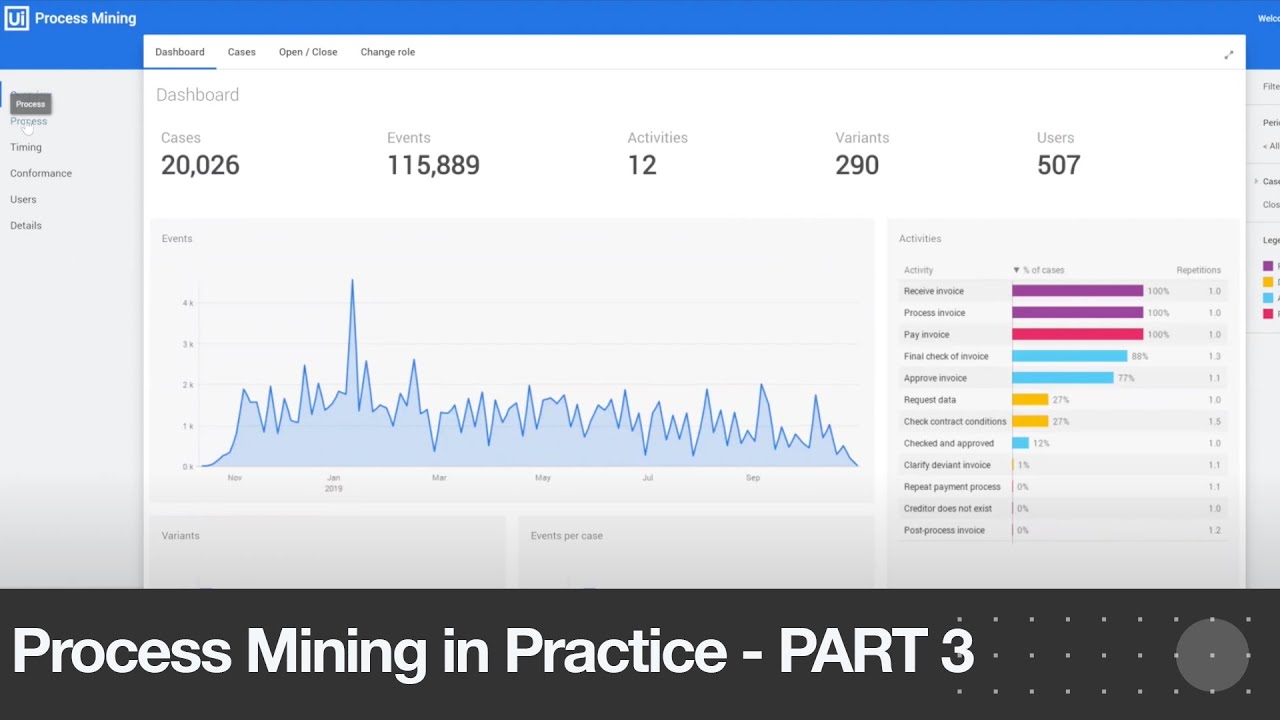

The video below explains how an internal auditor can use UiPath Process Mining for more efficient risk management.

Process mining is here to change the way we do audits and accelerate audit deliverables in our new normal. Envisioning a more efficient, digital world, UiPath Process Mining:

Shortens audit time

Shows the real process, not the intended one

Allows auditors to use a large dataset for a broader picture

Increases audit customer satisfaction

Helps to determine risks

Allows auditors to perform audits digitally, from anywhere

UiPath Process Mining compiles the entire data about a process into a comprehensive story. Manually analyzing the process graph an auditor can take the analysis as far as forecasting the short-term future.

Thanks to its ability to compile the process history into a comprehensive, detailed graph, process mining makes predictions possible, empowering auditors to advise on the short-term future, rather than exclusively pointing at past inefficiencies.

As we can see, all audit companies may have to use process mining in the future. And yes, it is inevitable. Process mining no longer represents the purely scientific field – it is here and changing the way people work.

Process mining is one of the ways to speed up your complex processes like financial audits. See how robotic process automation (RPA) improves the time spent on routine tasks in finance and accounting. Claim your complimentary copy of our recent white paper!

Topics:

Process Mining

Global Demand Generation Program Manager, UiPath

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.